child tax credit october 15 2021

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Last year the increased Child Tax Credit was a birth parents.

Child Tax Credit 2021 When Will October Payments Show Up Kens5 Com

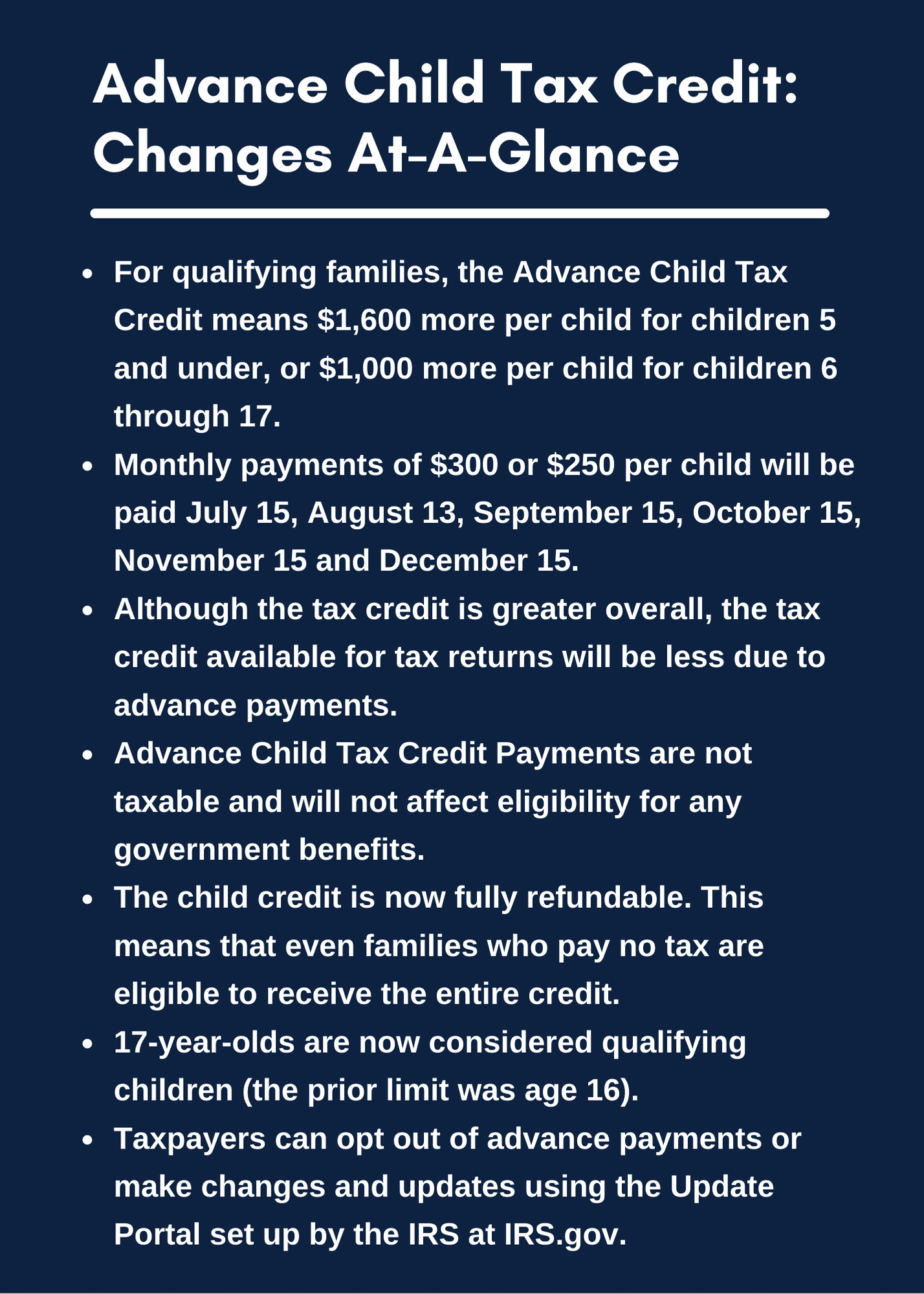

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children. Generally this is 1800 per younger child and 1500 per older child the nonprofit explains. October 8 2022 Ritika Khara Stimulus Check US Local News 0.

In terms of monthly payments families will receive their check for 300 for each child under 6 years old. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. As you may know the American Rescue Plan dramatically expanded the Child Tax Credit CTC to a maximum of.

The CTC has been revised in the following ways. All eligible families could receive the full credit if they earned. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

October 15 Deadline Approaches for Advance Child Tax Credit. Child Tax Credit Dates. The American Rescue Plan has expanded the CTC for the 2021 tax year.

Thats an increase from the regular child tax. IR-2021-201 October 15 2021. Thats an increase from the regular child tax.

Those who did not receive monthly payments in 2021 can file a tax return to get their. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. Checks will be sent out from October 15 and should arrive in bank accounts within days.

The IRS has confirmed that theyll soon allow. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days.

2 days agoOnline registration is still open till Nov. The credit is worth between 250 and 300 a month per child to eligible families and was signed into law by President Joe Biden as part of the 19 trillion American Rescue. The ARPA increased the CTC from 2000 to 3000 per child for children between 6 years and 17 years and 2000 to 3600 for children below 6 years.

The age limit was also. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

The credit tops out at 3000 for children between 6 and 17 years old. Next payment coming on October 15. Supplemental Security Income Benefits.

The child tax credit scheme was expanded to 3600 from 2000 earlier this year. Although the Child Tax Credit CTC has been reduced to 2000 per child for the 2022 tax year there is still time to take advantage of the enhanced CTC of 2021. Some residents of Rhode Island will be getting payments from the state government in the form of Child Tax Rebates that pay families up to of 250 per child for up to.

These changes will only apply for the 2021 tax year. Everything you need to know. All eligible families could receive the full credit if.

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

Child Tax Credits Are Expected To Start Arriving In July Here S What To Know Bridge Michigan

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Child Tax Credit Update 2021 Parents Warned To Register For Monthly Payments Now As October Deadline Approaches The Us Sun

Child Tax Credit 2021 2022 What To Do If You Didn T Receive Your Payment Last Year Marca

Child Tax Credit Payment Schedule For 2021 Kiplinger

The Child Tax Credit Research Analysis Learn More About The Ctc

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Sends Out The October Ctc Payment

The Child Tax Credit Is Working Let S Make It Permanent The Washington Post

Using The Child Tax Credit To Boost Your Banking

Child Tax Credit 2021 What S New In It And What To Know Prescott Enews

September Child Tax Credit Payment How Much Should Your Family Get Cnet

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa

Child Tax Credit 2021 8 Things You Need To Know District Capital

The American Families Plan Too Many Tax Credits For Children

Child Tax Credit Dates Next Payment Coming On October 15 Marca